Roth ira growth calculator

Naturally it makes sense to take full. If thats the case knowing the difference between qualified and non-qualified distributions can help you minimize any tax consequences.

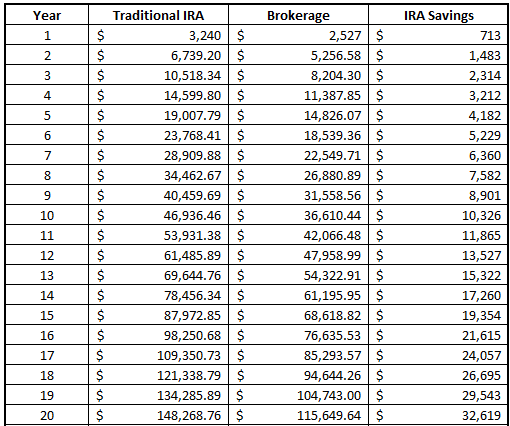

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Related Retirement Calculator Investment Calculator Annuity Payout Calculator.

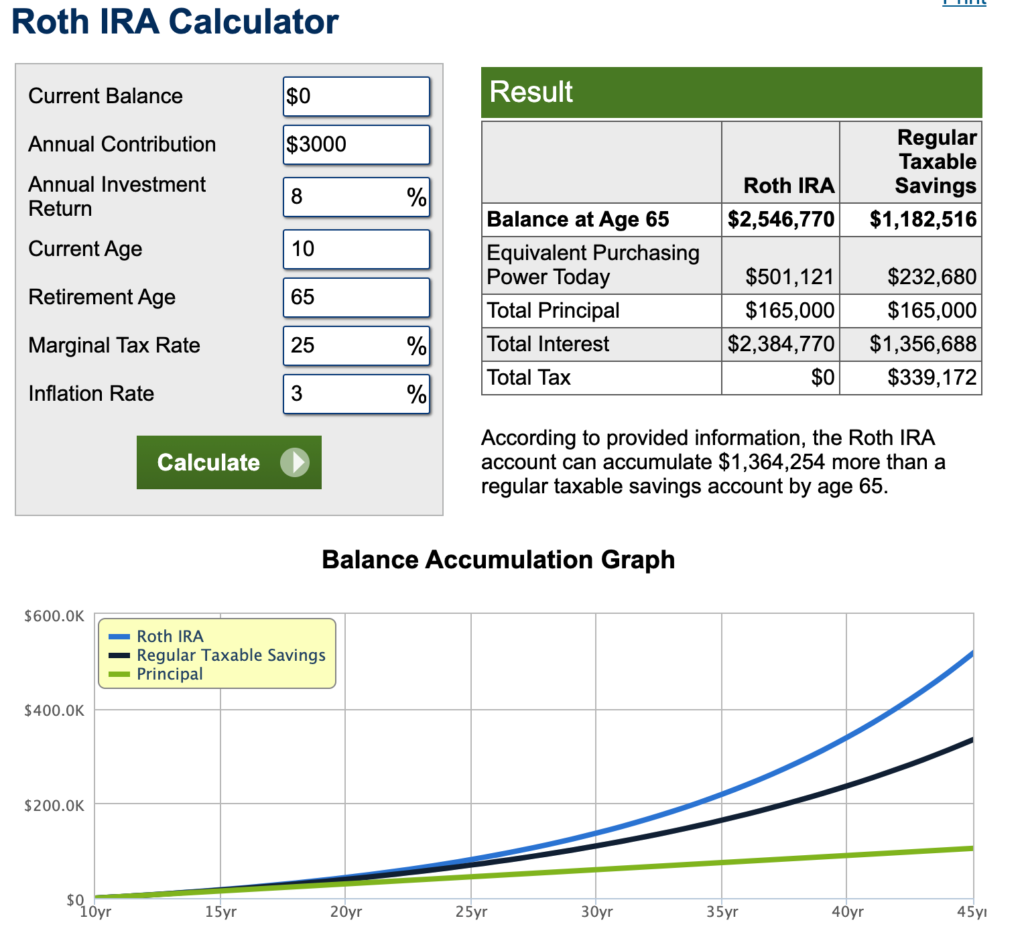

. A Roth IRA is one of the best possible ways to invest for retirement and in fact many experts think its the single best retirement account to have. 3 Setting up automatic IRA contributions will take extra paperwork but its worth the time to make sure youre putting away money for retirement consistently. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you used.

Heres the lowdown on Roth IRA rules including contribution limits eligibility rules income phase-outs and withdrawal limits. A Roth IRA is an individual retirement account designed to help you save for retirement. The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be withdrawn tax-free.

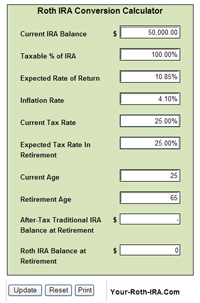

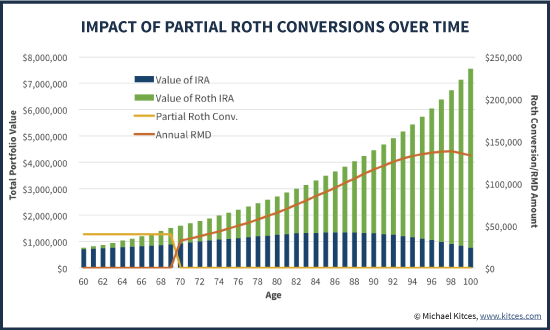

A Roth IRA conversion lets you move some or all of your retirement savings from a Traditional IRA Rollover IRA SEP-IRA SIMPLE IRA or 401k into a Roth IRAThere are no age limits to convert and as of January 1 2010 the IRS eliminated Roth IRA conversion income restrictions allowing you to start taking advantage of unique Roth IRA benefits even if your current income. Rather a backdoor Roth IRA is a strategy that helps you save retirement funds in a Roth IRA even though your annual income would otherwise disqualify you from accessing this type of individual. You can still take advantage of the tax-free growth and distributions down the road through a.

This individual retirement account is for those who are looking for tax deferred growth potential as IRA contributions may be tax deductible depending on your circumstances. Which IRA is right for you. Instead its a strategy investors can use to convert funds from a traditional IRA to a Roth IRA.

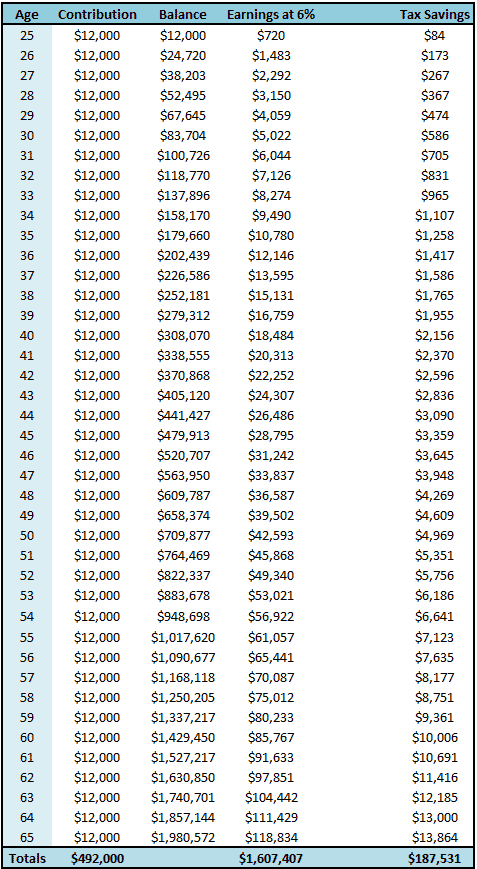

Contribution limits for 2021. If youre 50 or older and need to catch up you can add an extra 1000 for a total of 7000. For 2022 you can invest 6000 in either a traditional IRA or a Roth IRA.

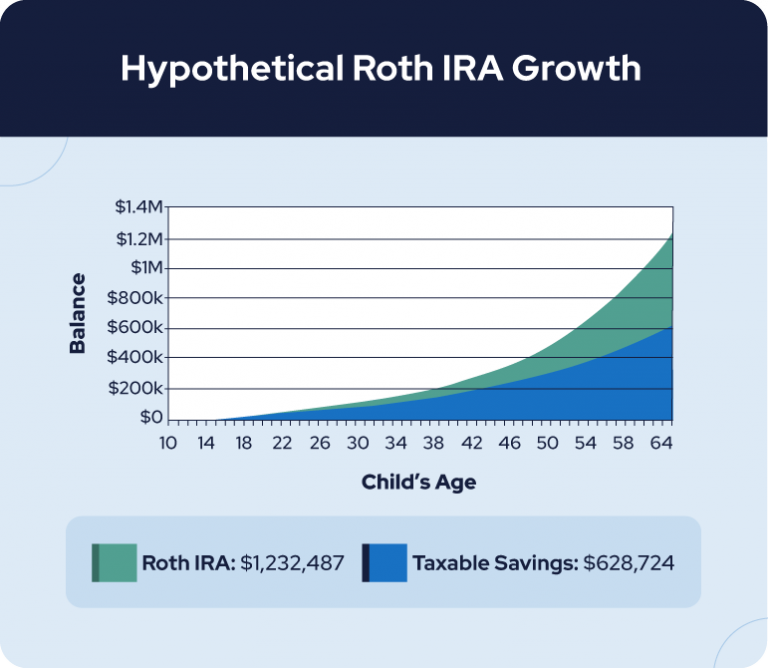

So a teenager who earns 3500 through a summer job could use that money for other purposes while the childs parent or grandparent contributes the 3500 to the teens Roth IRA. Creating a Roth IRA can make a big difference in your retirement savings. However this account is different from a traditional IRA because you contribute after-tax money to it so in retirement you can withdraw your money tax-free.

What Is a Backdoor Roth IRA. Open a Roth IRA. The use of the word backdoor in the title stems from the fact that this strategy is typically used by investors who are ineligible to contribute directly.

Despite what it sounds like a backdoor Roth IRA isnt actually a type of retirement account. Roth IRAs were designed to help people save for retirement with the advantage of tax-free growth. The growth in your Roth IRA and any withdrawals you make after age 59 12 are tax-free as.

Use a retirement calculator to determine how a Roth IRA. That doesnt mean you wont need to withdraw money early. Personal retirement calculator Article.

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. A Roth IRA can work as a backup account if youre saving. Roth IRA A Roth IRA is also a retirement account that you open and fund yourself not through an employer.

Set an action plan for your retirement years Solution. As Mancini explained the IRS doesnt care where the funds deposited in a Roth IRA come from as long as the account holder has earned that amount. A Roth IRA works best when you reap tax-free growth from long-term investments.

There is no tax deduction for contributions made to a Roth IRA. Many people pay fewer taxes on these earnings because they move to a lower tax bracket after retirement. It allows for after-tax contributions with the potential for tax-free income in retirement.

You can use our investment calculator to customize. Early withdrawals from an IRA trigger taxes and a 10 penalty. The concept behind Roth IRA is that you make contributions to this account with after-tax moneyOnce you turn 59½ and have been in a Roth IRA plan for five years all distributions taken from the plan are tax-free.

You can contribute to a Roth IRA after retirement but only if you have compensation income. However all future earnings are sheltered from taxes under current tax laws. And what you expect your annual return to be.

From tax advantages maximum contribution and fees here are some details that can convince you to consider a Roth IRA. A Roth IRA conversion is a way to move money from a traditional SEP or SIMPLE IRA or a defined-contribution plan like a 401k into a Roth IRA. If you meet a qualifying distribution event the Roth IRA can provide truly tax-free growth potential.

6000 or 7000 if you are over 50 years old. A Roth IRA is a retirement account that lets your investments grow tax-free. But sometimes early distributions are tax free and penalty free.

The Roth IRA was created through the Taxpayer Relief Act of 1997 to provide an alternative to making nondeductible contributions to traditional IRAs. It means you wont pay any taxes when you use that money in retirement.

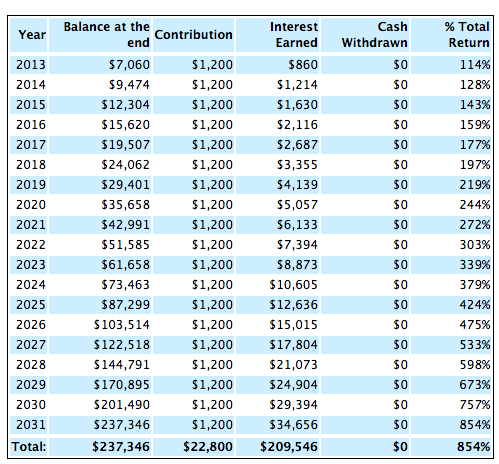

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Roth Ira Calculators

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Ira Calculator See What You Ll Have Saved Dqydj

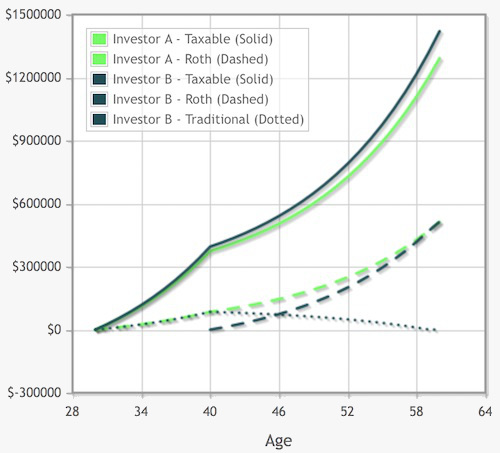

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Traditional Vs Roth Ira Calculator

Roth Ira For Kids A Truly Life Changing Strategy See The Forest Through The Trees

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Historical Roth Ira Contribution Limits Since The Beginning

Systematic Partial Roth Conversions Recharacterizations

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Best Roth Ira Calculators

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Roth Ira Calculator Roth Ira Contribution

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq